Off the bloody rails

WHY AREN'T RAILROADS STANDARDISED

It’s been a while! Today I want to talk about railroad track gauges, the histories of how they differ worldwide, barriers to overcoming incompatibility, and potential economic benefits to doing so.

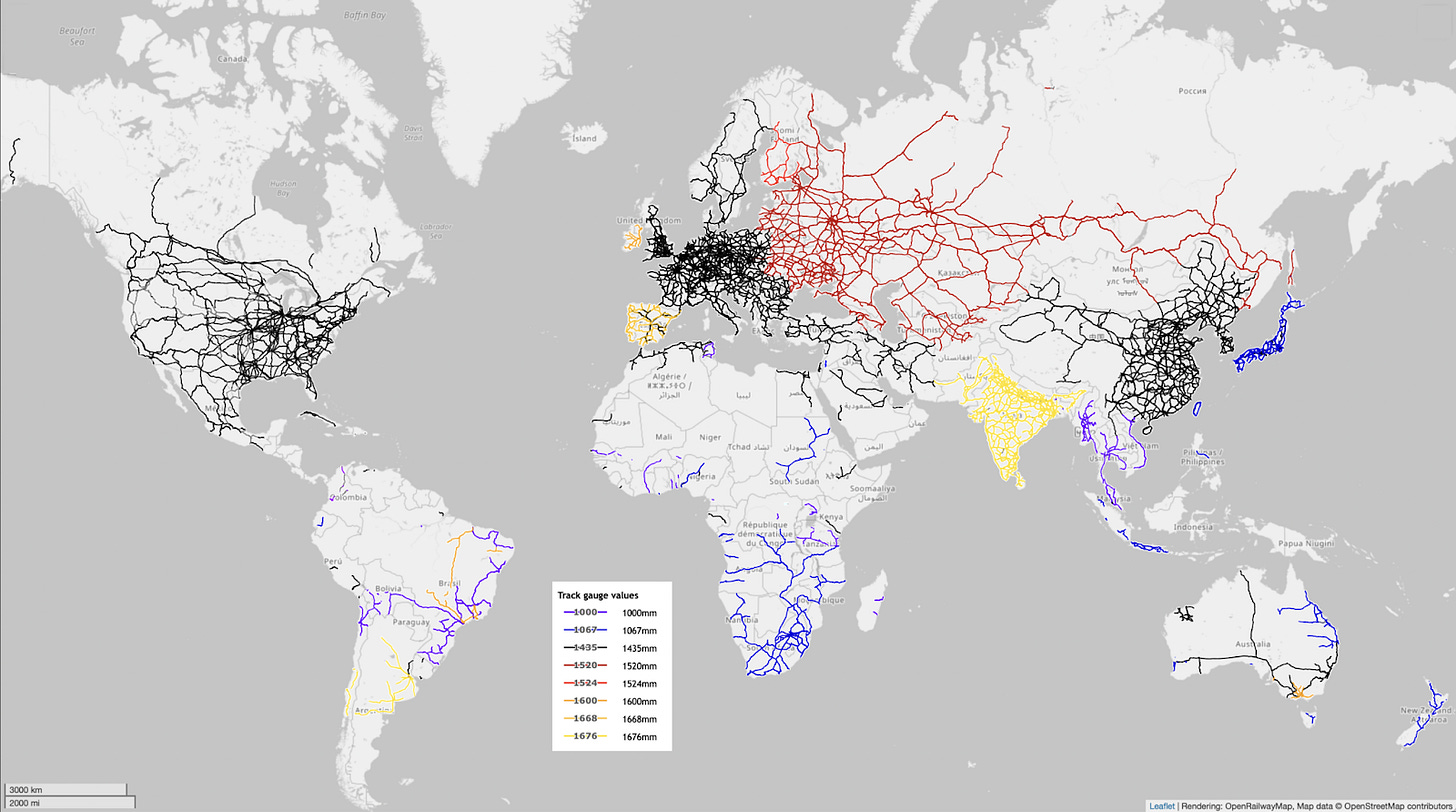

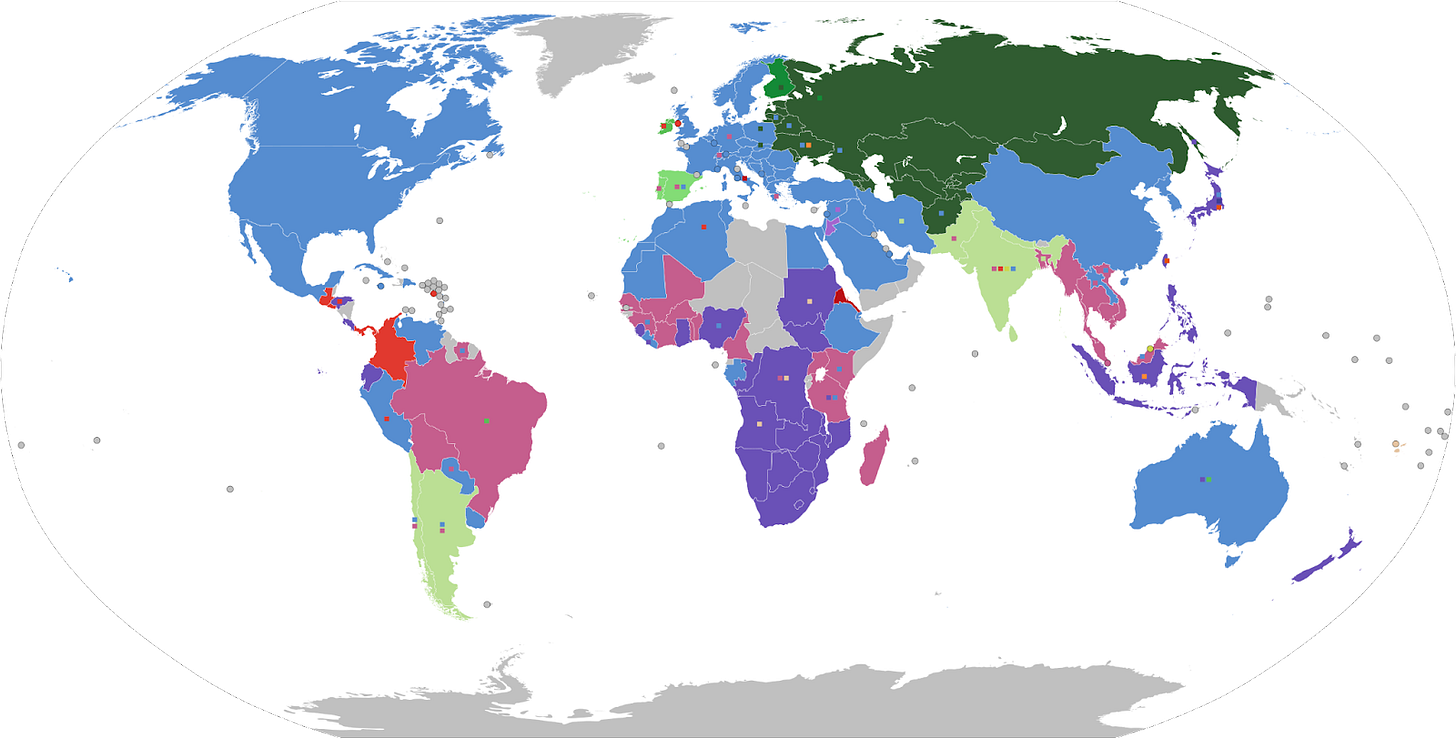

“Track gauge” refers to the distance between the two rails of a railroad track. Here are two maps of the world indicating the different track gauges that are in use.

Rationale for different track gauges

In a nutshell, narrower-gauge railroads are cheaper to manufacture, while broader-gauge tracks can support higher speed and capacity transport. Narrow-gauge tracks require less raw materials to lay track, such as narrower railroad ties/sleepers (the perpendicular supports underneath the rails) and less track ballast (the rocks underneath the railroads). Importantly, civil engineering costs are lower, because smaller bridges and tunnels are required. Narrower-gauge tracks can also facilitate tighter turns. All of these factors make narrow-gauge railroads better suited for mountainous areas, or areas with low demand for rail or with temporary rail (such as large construction, mining or logging sites).

Path dependence and network effects

The differences in track gauges globally is a typical example of path dependence, where one initial decision constrains future decisions. Once a rail gauge is selected and consolidated, there is a large fixed cost associated with replacing the tracks with a different gauge. However, there is also a small cost incurred every time goods are shipped across a break of gauge (i.e. where the railroad system goes from one track gauge to another).

When countries first constructed their own rail networks, the importance of interconnectivity was outweighed by local geographic concerns, especially as interregional trade volumes were relatively low. Countries thus selected different track gauges in a more haphazard way, informed by the other considerations above. Indeed, even within countries, track gauges differed by region or by the rail operator. As can be seen in the maps above, there are some intra-national differences to this day.

In the long run, eliminating break of gauge costs by unifying rail networks is likely to outweigh the fixed costs of replacing differently-gauged tracks. Rail transportation costs will fall, incentivising producers to substitute rail for other modes of transport when shipping their goods. Producers that did not ship goods beforehand due to prohibitive transport costs may now do so, integrating markets across a larger geographical area. This will, other things being equal, (as ever in economics!) decrease prices and increase variety.

As can be seen above, track gauges have largely converged to a few dominant types, with the benefits from interconnectivity often outweighing the other factors favouring differently-gauged tracks. This relates to the economic phenomenon of network effects. Generally, a network effect (or network externality) is when the value a consumer gets from a particular good or service depends on the number of other consumers – social media networks are a good example. In the context of railroads, the more nearby railroads are using a certain gauge, the greater the gains for a particular railroad from conversion. Ideally, all interconnected railroads would use the same gauge – but path dependence means that switching from an existing track gauge is costly.

Gauge conversion mechanisms

(Feel free to skip this section if you just want further discussion of the economics and aren’t viscerally fascinated by the finer engineering points of track gauges…)

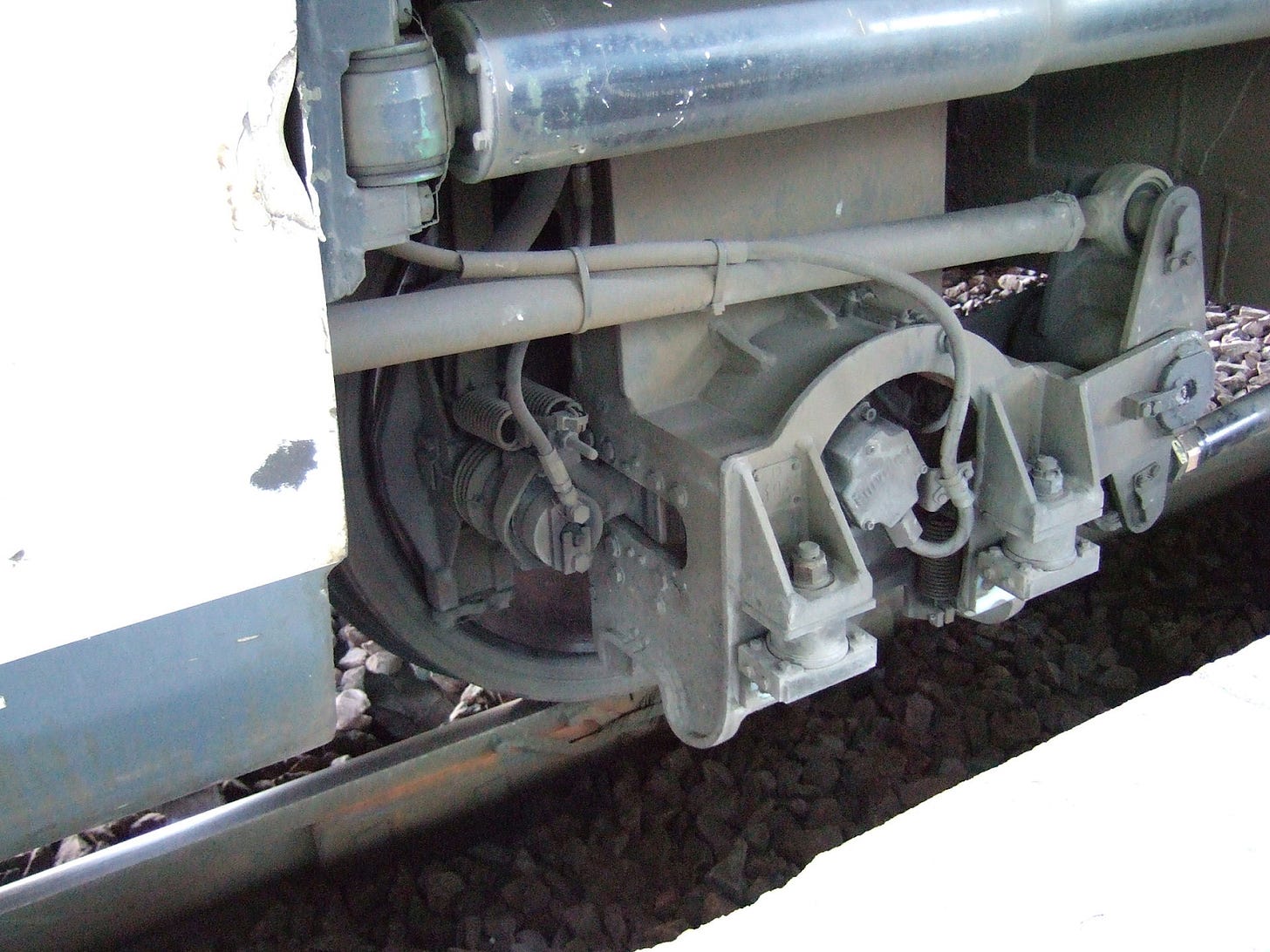

A bogie (or truck) is the chassis that carries the train’s wheelset (wheels and axles). The wheelset is calibrated according to the gauge that the train runs on, and so is generally incompatible with other track gauges. Bogie exchange simply refers to the process of removing the bogies from a railcar and replacing them with bogies with differently spaced wheels. This is a time-consuming process, though generally less time-consuming than transloading (unloading and re-loading all of the cargo), which also requires rolling stock to be kept idle at either side of the break of gauge to facilitate the transfer.

At the break of gauge point, train wagons with wheelsets calibrated to one gauge can be laid onto wheelsets calibrated to the other gauge. One method is on transporter wagons, where individual wagons (or even an entire train) are carried on differently gauged flatcars (empty traincars with nothing but a chassis and a flat bed).

The transfer of goods across the break of gauge is thus quicker than transloading, however there are a couple of drawbacks. Firstly, when the transporter wagon is narrower-gauge than the wagon that it is carrying, the structure as a whole is not very stable and so is restricted to travelling at lower speeds. Secondly, carrying wider-gauge wagons on narrower-gauge railroads means that structures like tunnels must be wide enough to accommodate them, which undermines one of the main cost advantages of narrow-gauge railroads.

Similarly, rollbocks are identical to transporter wagons, but rather than being a whole flatcar, the rollbocks are just bogies (see the image below). They are thus cheaper than transporter wagons, but otherwise have the same pros and cons.

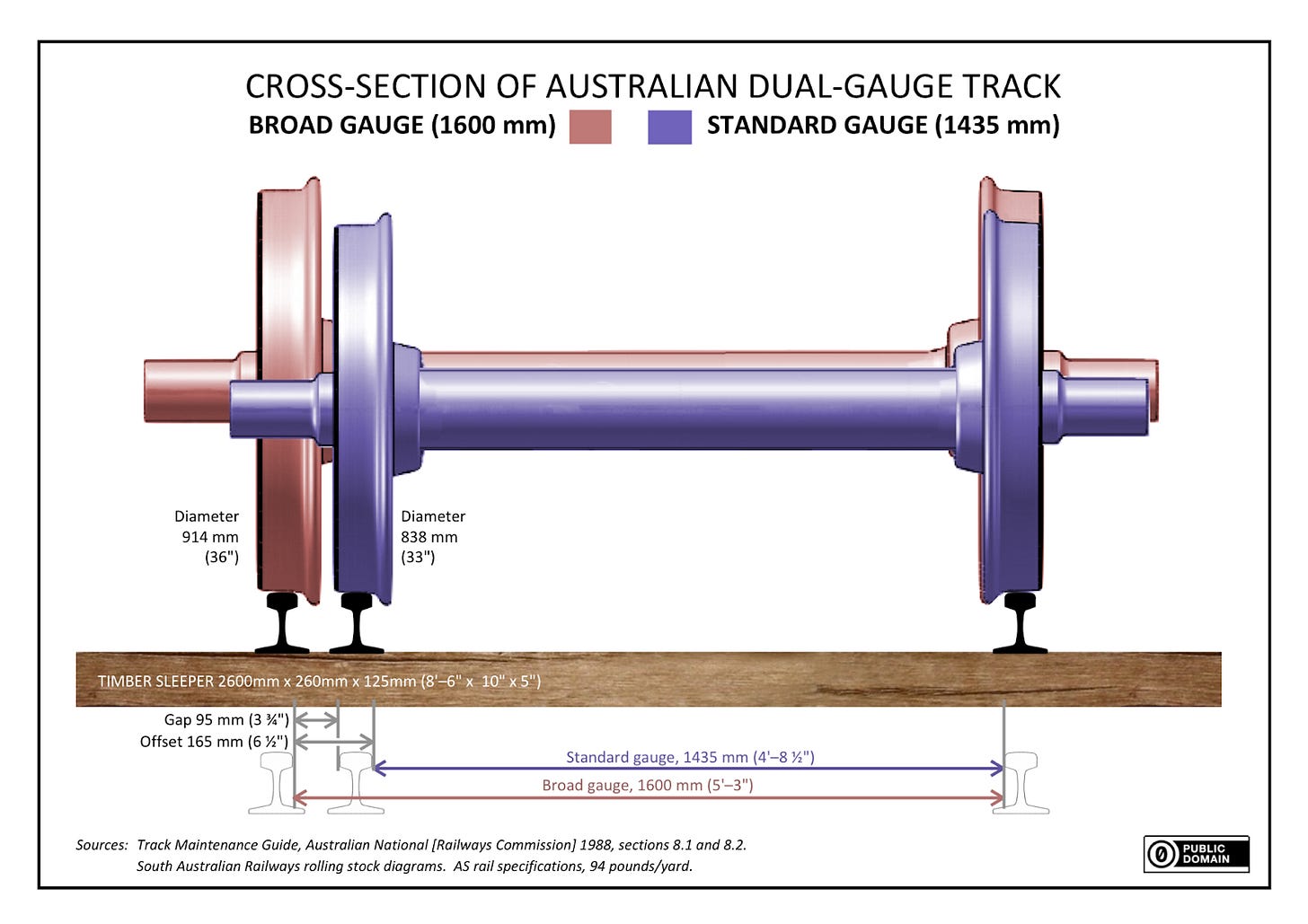

A multi-gauge track is a track system where different track gauges are superimposed on each other, allowing trains with differently calibrated wheelsets to all operate on the same line (see below for an example of a dual-gauge track).

However, these are more expensive to configure with signals and sidings (small sections of track that branch off from the main line) than separate single-gauge tracks. So they are typically only used when there is not enough space for separate tracks, or where differently-gauged tracks meet (e.g. yards and stations).

A variable gauge system uses a variable gauge wheelset, in which the distance between the wheels can be adjusted to fit the track gauge. At a break of gauge, the wheels are unlocked, the distance between them is adjusted, and then they are re-locked. For example, Spain and France use different track gauges. On the border, Spanish Talgo trains, which have variable gauge wheelsets, are able to drive across a gauge change system at a speed of 10–15km/h, with one pair of wheels per second being adjusted.

The Southern US gauge conversion (and an econ paper!)

Beginning on the morning of the 31st May 1886, 13,000 miles of railroad track across the Southern US were manually narrowed from a 5’ 0” to 4' 9” gauge, in order to be compatible with the rest of the country (which used the 4’ 8.5” “standard gauge”). This conversion happened over the course of a mere 36 hours! This provides a perfect natural experiment: the sudden, essentially exogenous change means that we can infer the direct causal (or as close as we can get to causal) effects of the switch. Daniel Gross has written a working paper about the economic effects of this sudden shift. The paper found that the gauge change caused a large fraction of freight traffic to switch from steamships to railroads, but total traffic and prices were unchanged.

The railroads represented a collusive oligopoly, where a few large firms collectively held the vast majority of the market share, and deliberately cooperated to fix prices and boost profits. This, other things being equal, reduces consumer surplus and results in a deadweight loss (loss of total surplus) relative to a perfectly competitive market. Consumer surplus didn’t benefit much from the gauge conversion though, because the railroad firms’ collusion prevented the pass-through of cost savings, thus reducing the potentially positive effect on total demand (ie. total shipments).

However, the collusion itself may have facilitated the gauge conversion, by easing coordination and guaranteeing a recouping of the fixed costs through the elevated prices. An individual railroad changing gauges generates positive externalities (benefits enjoyed by third parties) for other railroads by connecting them more directly to the rest of the US railroad system. Thus the total benefits of the gauge change would not be enjoyed by a single railroad firm unilaterally changing gauge, reducing their incentive to do so. The collusion essentially merges all of the Southern railroads into one monopoly, allowing them to jointly internalise these positive externalities, and thus facilitating the conversion.

Thus, collusion may support standardisation across firms in the same market which, ceteris paribus, would decrease market frictions, reduce costs and increase consumer surplus. This creates a tension for regulators, as this potential benefit has to be weighed against the anticompetitive nature of cartels, which, by raising prices and/or restricting output, harm consumers.

In 1875, Southern freight carriers formed a cartel, the Southern Railway & Steamship Association (SRSA), in order to collusively fix their prices. Railroad companies that refused to join were denied through traffic, and any carriers that deviated from the fixed prices were punished. This came in the form of the rest of the SRSA temporarily slashing their prices in order to deny the deviator revenue; this threat enforced collusion.

Trade between the South and the rest of the US rose over the course of the 1880s, and the cost of delays grew in proportion to this increase in volume. Thus, over the course of 1885-6, the SRSA agreed to convert to a gauge compatible with the rest of the US.

The paper empirically examines the effects of the gauge change on freight quantity (measured in pounds) on different transport routes between Northern port cities and the inland South. It uses a differences-in-differences-in-differences approach: it tries to isolate the effect of unifying track gauges on freight quantity based on discrete changes in 3 factors. Firstly, a distinction is made between all-rail routes and routes that include transportation via steamship: steamships obviously bypassed breaks in gauge and so provide some degree of comparison. Secondly, the distance of routes (measured as straight-line distances for ease) is an important factor: breaks in gauge represent a fixed cost, so represent a higher share of costs on shorter routes. Removing breaks in gauge would thus likely have a more positive effect on freight shipped on short-distance rail routes. Thirdly of course, a distinction is made between transportation before and after the gauge change.

A similar model is then used to estimate the market shares (rather than just freight quantities) of all-rail vs steamship transportation, before and after the gauge change. Finally, the paper also contains a regression to examine the effects on combined traffic across both route types.

The paper finds that the all-rail share of traffic (relative to traffic using both steamship & rail) significantly increased on shorter routes, but there was no change on longer routes. Importantly, there was no increase in total shipments across both kinds of transport routes. Thus, the gauge change prompted substitution across modes but did not result in an overall increase in freight transported. The paper also examines stock-market returns, finding that the gauge change was associated with large, positive abnormal returns to the Southern railroads that were directly connected to the rest of the country.

The paper also uses simplifed theoretical models to explain when railroad firms might or might not be incentivised to standardise their railroads. Given some assumptions about the sizes of the profit changes relative to the fixed cost of conversion, the models predict that standardisation of two competing rail routes (with the same termini) is only possible in a collusive market. By eliminating the break in gauge, collusive prices are predicted to fall by a small fraction of the break in gauge cost, the all-rail market share would rise relative to steamships, and total shipments would rise by another fraction of the break in gauge cost. However, prices and total shipments do not change after standardisation if price adjustments are costlier than the potential post-adjustment profits.

The paper argues in reality, the lack of price (and hence total shipment) changes was due to both the costliness of price adjustments (as described in the theoretical model) and the nature of the cartel, which reduced pass-through of cost savings. Price adjustment within the SRSA cartel involved contentious debate, requiring unanimity from often-opposed cartel members or a majority from the internal board of arbitrators.

I’ll end with the final paragraph from the paper, linking its findings to the literature:

The results also contribute to the largely-theoretical academic literature on technological compatibility. Compatibility standards can be found in nearly every technical product and industry, but to-date there is limited evidence directly linking them to firms’ or market outcomes. In unveiling the ways in which the Southern gauge change affected the market for freight shipment, this paper provides a historical datapoint on the effects of compatibility on transactions and has implications for other settings where traffic is exchanged across connecting, incompatible networks, such as the those identified above. With archival data becoming increasingly accessible, historical settings such as the early U.S. telephone and railroad industries present a growing opportunity for future research on network connection, compatibility, and related themes.